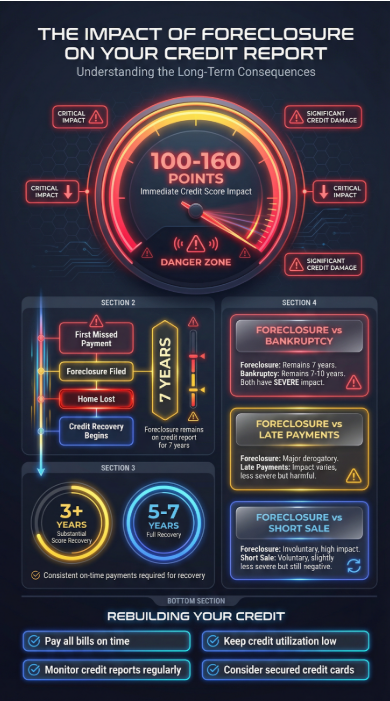

Early Action Can Reduce Long-Term Damage, although an initial 1 x 30 day late on your mortgage will cost 125-150 points. This makes refinancing near impossible!

Foreclosure damage usually compounds month by month.

Each additional late report can deepen score drops and extend recovery timelines.

Even when foreclosure feels unavoidable, how you move through it still matters.

While there are few ways to mitigate credit damage, there are things our Sister company Fix My Report offers as part of their service. Free to you once we decide to move forward together.

If you’re dealing with property pressure and credit decisions at the same time, waiting — or acting too quickly — can quietly narrow your choices.

A short conversation can help you understand what’s time-sensitive, what isn’t, and how to avoid decisions that could damage your credit or financial future.

In some situations, people are able to move forward without immediate relocation, allowing time to sort out next steps responsibly. We’ll talk through what’s realistic for your situation — clearly and without pressure.

Call before options narrow:

844-267-3946

Talk with us about your timeline

Share the property address and a way to reach you. We’ll take it from there.