It’s Also Fixable — When Done Correctly.

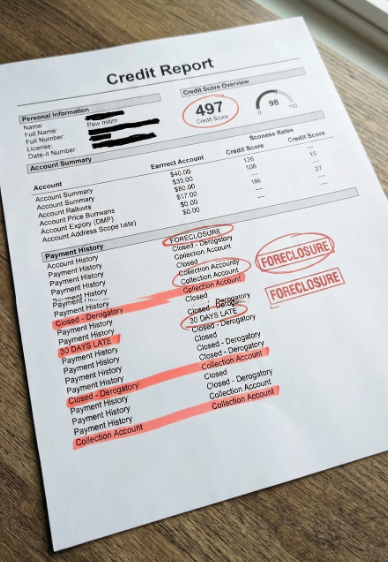

A drop in Credit Score will affect housing, costs of living, credit cards rates, insurance costs and impact peace of mind.

Rebuilding scores works best with a clear plan, not random actions.

It typically involves:

Two people with the same score often need completely different strategies.

If you want expert analysis, that’s what FixMyReport.com exists to provide.

If you’re dealing with property pressure and credit decisions at the same time, waiting — or acting too quickly — can quietly narrow your choices.

A short conversation can help you understand what’s time-sensitive, what isn’t, and how to avoid decisions that could damage your credit or financial future.

In some situations, people are able to move forward without immediate relocation, allowing time to sort out next steps responsibly. We’ll talk through what’s realistic for your situation — clearly and without pressure.

Call before options narrow:

844-267-3946

Talk with us about your timeline

Share the property address and a way to reach you. We’ll take it from there.